monterey county property tax due dates

Friday December 10 2021 Be sure to mail your tax payments postmarked by the United States Post Office on or before the December 10 2021 delinquent date in order to avoid a 10 penalty. District 5 - Mary Adams.

Before Buying A Home See What S Right For You Infographic First Team Real Estate Home Buying Tips Buying First Home Real Estate

Payments may also be made in person at the county tax collectors office 168 W Alisal St.

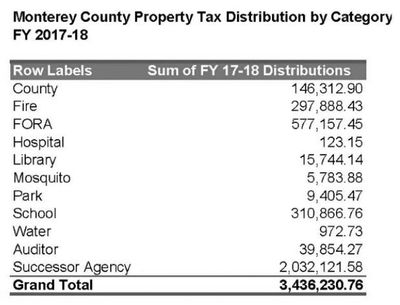

. You will need your 12-digit ASMT number found on your tax bill to make payments by phone. First half of real estate taxes are scheduled to be due Friday February 18 2022 in the Treasurers Office. Not only for Monterey County and cities but down to special-purpose districts as well eg.

Monterey County collects on average 051 of a propertys assessed fair market value as property tax. Normally local school districts are a significant draw on property tax funds. On or before November 1.

MONTEREY 2022 Property Statement E-Filing. August 1- Unsecured bills due. 2022 Property Statement E-Filing E-Filing Process.

Additional evidence supporting your appeal will be needed. Ad Find Monterey County Property Records - Get Results In Minutes. For E-Check a flat fee of 025 is charged.

NOTICE OF CURRENT PROPERTY TAXES DUE SECURED 2021-2022 I Mary A. Secured property taxes are levied on property as it exists on January 1st at 1201 am. If you own property in Monterey.

Choose Option 3 to pay taxes. District 2 - John M. Tax bills are generated every fiscal year July 1 through June 30 and mailed in mid-October and payment may be made in two installments due as follows.

Monterey County collects on average 051 of a propertys assessed fair market value as property tax. The state relies on real estate tax revenues a lot. The median property tax in Monterey County California is 2894 per year for a home worth the median value of 566300.

When you have completed the E-Filing. If ordered by board of supervisors first installment real property taxes and first installment one half personal property taxes on the secured roll are due. Only current year taxes may be paid by phone.

District 3 - Chris Lopez. Second Installments of 202122 Annual Secured Property Tax Bills are due as of February 1st. The median property tax also known as real estate tax in Monterey County is 289400 per year based on a median home value of 56630000 and a median effective property tax rate of 051 of property value.

Second-half real estate taxes are scheduled to be due Friday July 15 2022. It costs money to protect citizens in a pandemic. On or before November 1.

District 1 - Luis Alejo. Monterey County property taxes still due on Friday. Publish notice of dates when taxes due and delinquent.

At the local level the money in the Monterey County government coffers is paying for services like a public health laboratory. Sewage treatment plants and athletic parks with all dependent on the real property tax. January 1 - Lien date the date taxable value is established and property taxes become a lien on the property.

Monterey County has one of the highest median property taxes in the United States and is ranked 178th of the 3143 counties in order of median property taxes. All major cards MasterCard American Express Visa and Discover are accepted. Payments can also be made by telephone.

630 PM PDT Apr 8 2020. Between January 1 2022 and March 31 2022. August 31 - Unsecured deadline.

Property Taxes Due Dates. Any property owner with questions about their property tax bill should contact the Tax Collectors Office at 831-755-5057 or taxcollectorcomonterey. For assistance in locating your ASMT number contact our office at 831 755-5057.

State law says local tax collectors cannot extend the date. Enter a Full US Address to Find Informative Monterey Cty Property Records Fast. PROPERTY TAX DUE DATE The deadline for payment of the first installment of 2021-2022 Monterey County Property Tax is.

The TreasurerTax Collector serves the residents of Monterey County and public agencies by protecting the public trust through the delivery of valuable professional and innovative services in the collection of property taxes. 1st Installment - Due November 1st Delinquent after 500 pm. 1-831-755-5057 - Monterey County Tax Collectors main telephone number.

Clerk of the Board. District 4 - Wendy Root Askew. Salinas or checks can be dropped off at the City Finance Offices in Carmel Seaside and King City.

July 1 - Beginning of the Countys fiscal year. Welcome to the E-Filing process for Property Statements. For credit cards the fee is 225 of the total amount you are paying.

A convenience fee is charged for paying with a CreditDebit card. At any time prior to submitting the Statement for E-Filing you may printsave a draft copy for your review. Monterey County collects relatively high property taxes and is ranked in the top half of all counties in the United States by property tax collections.

Yes you can pay your property taxes by using a DebitCredit card. Zeeb Monterey County Tax Collector hereby announce that regular secured tax bills will be mailed on or before November 1 2021 to all property owners at the addresses shown on the tax roll. 16 rows First installment of secured property taxes is due and payable.

Diamond Back Ranch Tehama County 3 243 Acres California Outdoor Outdoor California

Payment Options Monterey County Ca

Your Real Estate Professional Behind The Scenes Home Buying Real Estate Tips Home Buying Process

Take These Easy Steps To Homeownership Nar Homebuyertips Home Buying Real Estate Tips Home Buying Process

Steve Vagnini Monterey County Assessor And Recording Clerk Juliette Jette Ferguson Interviews Mr Steve Vagnini Monterey County Ferguson The Neighbourhood

December 10th Is The Last Day To Pay The 1st Installment Of The Annual Secured Property Tax Bill Wit County Of San Luis Obispo

Jimi Hendrix The Who Janis Joplin Etc Monterey Pop Festival Unused Ticket Monterey Pop Festival Monterey Pop Festival

Mary A Zeeb Treasurer Tax Collector California State Association Of Counties

600 Acres San Ardo Ca Property Id 8987819 Land And Farm San Ardo Things To Sell Forest Plants

Happy Mclaren Monday Y All While The Rest Of The World Waits For Mclaten P15 Senna Deliveries Or Even To See One There Were A F Dream Cars Car Ride Super Cars

Home Buying In 6 Steps Infographic Home Buying Real Estate Tips Home Buying Process

Renting Vs Buying A House Connecticut Real Estate Rent Real Estate

California Public Records Public Records California Public

3595000 Luxury Real Estate 150 Oak Way 4 Beds 5 Bath 2420 Sq Ft Built In 1932 Outside Area Inside Ca Luxur Home California Homes Luxury Homes

California Localities Extend Tax Relief To Marijuana Companies In Absence Of State Action